The project

A process plant wished to investigate alternative options for its future energy (steam and electric power) requirements. It was then purchasing both steam and electric power from an off-site energy plant on a take-or-pay contract which had some two years to run. Total peak requirements of the site were 60T/hr steam and 22MW electric power. The plant had the option of connecting to a local natural gas pipeline which offered the possibility of building an on-site gas-fired energy plant to replace the existing external source, which was expected to become more expensive at contract renewal time. Previous assessments, based on annualised plant costs, indicated that a cogeneration project would be uneconomic. It was suggested that the use of annualised figures would not indicate true site costs and, since estimates of steam usage and power import/export on an hourly basis were available from a previous analysis, these could be used to provide a basis for a project assessment based on actual plant operations.

The alternatives

The preferred option was a combination of an on-site gas-fired boiler and a combined-cycle gas-turbine generator and associated heat recovery boiler. A 15 MW gas turbine (GT) driven electrical generator would produce up to 34 tonnes/hr of superheated steam (at 410 C) in an associated heat recovery boiler (HRB). As this would be insufficient for the plant's peak steam needs, a separate gas-fired boiler would need to be provided, producing around 30 tonnes/hr of process steam (300 kPa, 220 C). Allowance was made for around 2 T/hr of high pressure steam from the HRB. A 4.8 MW back-pressure steam turbine taking around 32 T/hr would exhaust to the lower pressure system in the plant and act as a pressure-reducing device recovering steam expansion energy as electrical power for the site. The combined 20 MW capacity of these two turbines was less than the peak demand of 22 MW and power could be imported as required. Up to 6 MW could be produced from the back-pressure steam turbine if implemented in pass-out configuration, with some exhaust to a condenser. However in this configuration the pass-out flow returned to the plant would have been some 10 T/hr less than produced by the HRB. The missing steam would have to be produced by the gas-fired boiler, at a significant fuel cost penalty. By way of backup the HRB would be equipped for 100% supplementary gas firing should the gas turbine be unavailable. There were operational implications of this arrangement which would have a significant impact on the economics of the project. These could be revealed only by a dynamic-based analysis and related to possible loading restrictions which might be imposed on the gas-fired boiler.

The results

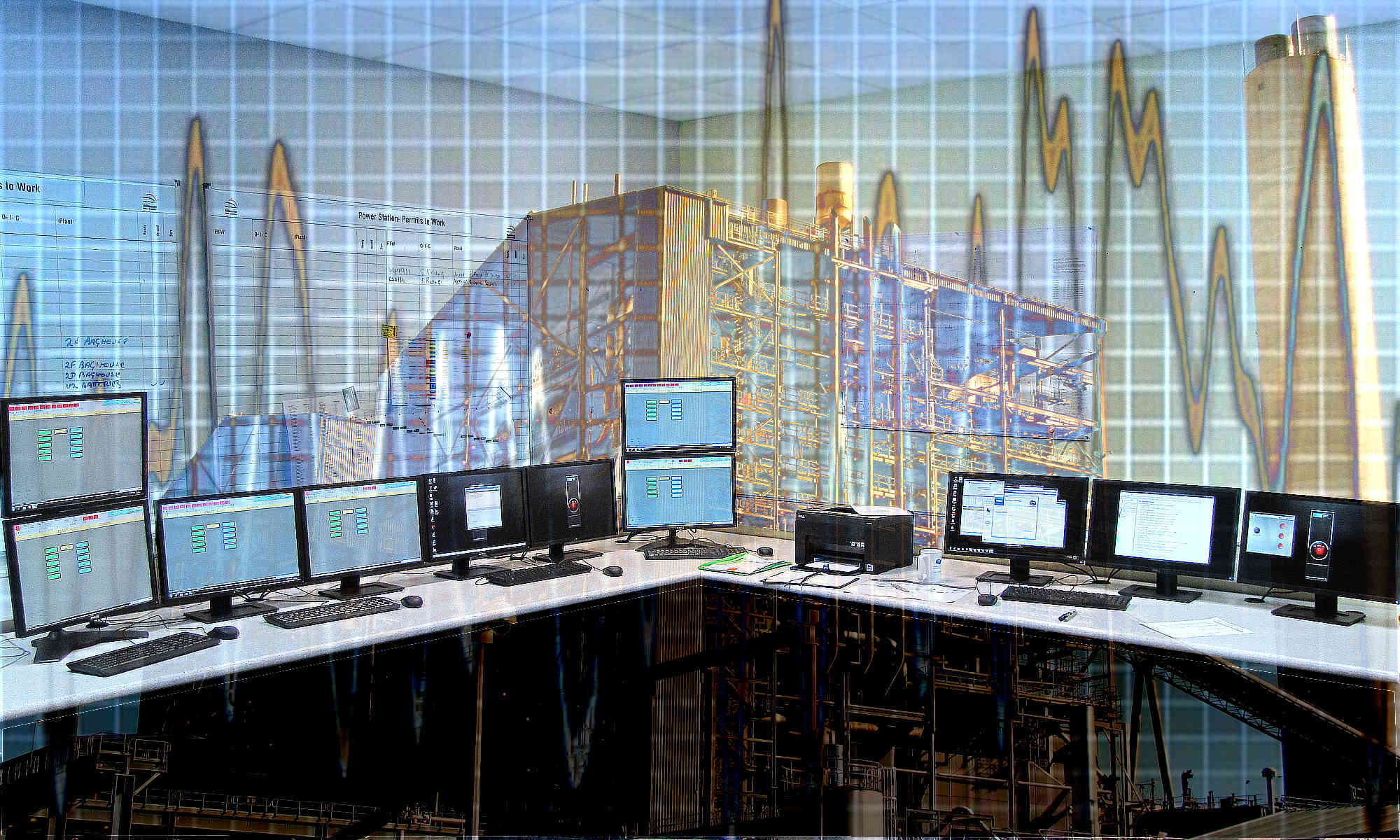

The following diagram summarises the results in the form of the calculated NPV of the cogeneration project of 15, 17 or 20MW capacities, for three assumed prices of imported and exported electric power ($/MWhr) and four of fuel gas ($/GJ), using a discount rate of 15%. Earnings from power sales were significant and supported the 20MW project as yielding the best value.

Case Study 1. A Dynamic Simulation of the Energy Plant at a Large Steelworks

Case Study 2. A Cogeneration Plant Financial Assessment

Case Study 3. A Process Plant Operations Analysis

Case Study 4. A Dynamic Analysis of Steam Utilities in an Oil Refinery